Every Filipino taxpayer inevitably needs to go to a branch of the Bureau of Internal Revenue (BIR) to transact their business there. It could be to secure the necessary papers for a housing loan, register a new business and get a Tax Identification Number (TIN) for it, or file an income tax return.

One crucial piece of information that anyone needs to know before making the trip is to make sure that you will be visiting the BIR branch in the correct sector, which is more officially known as the revenue district office or RDO. Otherwise, depending on the business with the BIR you need to transact, you may just be wasting your trip since going to the wrong RDO could mean that they will not be able to process your specific request. Here are the things you need to know about the BIR RDO codes and much more.

Main Image: Philippine Star

What is the Revenue District Office (RDO)?

The registration records of the BIR are not centralized, which could have made it convenient for any registered taxpayer to access their records at any BIR branch.

Instead, the department has set up more than a hundred RDOs across the Philippines that would cater to the needs of the taxpayers that are registered with them. An RDO is where the records of taxpayers registered with it are kept. It is important to note too that an individual may only be registered at one specific RDO at a time, meaning their records won’t be accessible at any other RDO.

Let’s say you work in Manila, then you need to know which RDO in the city you are registered as its corresponding code is what you will have to input in any BIR form you are filling out. When you transfer to a different company in another place, you will need to transfer to the RDO that has jurisdiction.

An RDO offers a lot of frontline services, with the most important ones being the issuance of TIN cards for every taxpayer (whether it be an individual or a corporate entity), and the processing of the TIN registration for first-timers. The BIR uses the TIN to quickly access a taxpayer’s information as well as process and track their transactions with the agency.

The TIN is needed by everyone filing income tax returns. Banks also require it when you want to open an account with them.

For those who may still be not aware of it, the specific TIN is assigned only once to an individual and will be associated with them for the rest of their lives. This means you can’t apply for a second TIN should you forget the one assigned to you. Instead, you would have to ask the BIR through any of its branches to retrieve your TIN for you.

RDO Codes

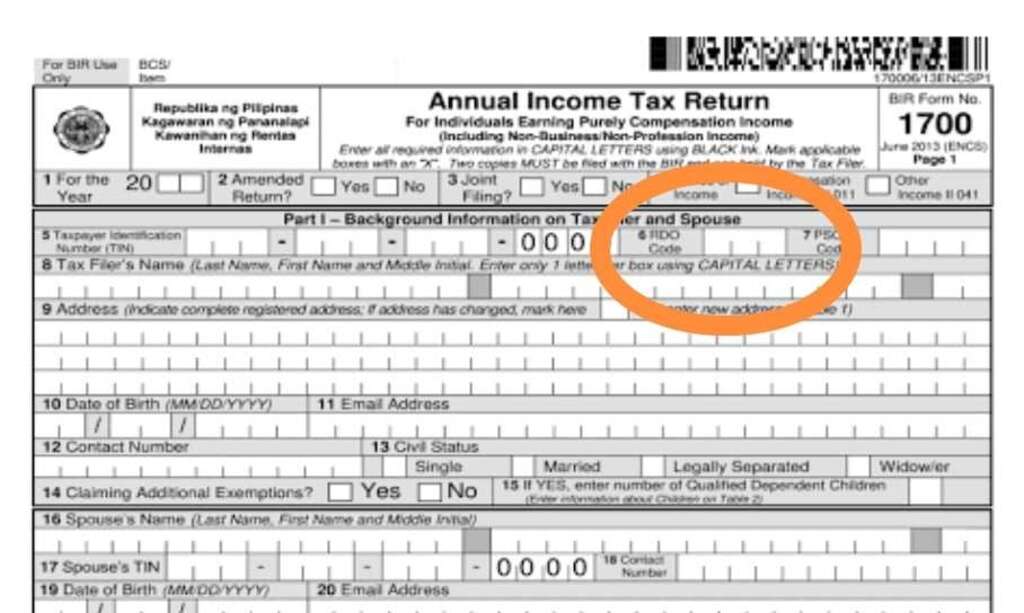

To make it easier to identify RDOs, especially in BIR forms, RDO codes are assigned to represent each one of them. These RDO codes enable the collections agency to monitor each region in the Philippines when it comes to the tax collected as well as process tax payments, tax returns, and withholding taxes in the area.

Taxpayers will need to enter the RDO where they are registered whenever they transact a business with the BIR.

RDO Codes vs. BIR Branch Codes

The TIN is a system-generated number made up of 12 digits. The first nine digits represent the TIN proper. For individual taxpayers, the last three digits are usually just zeroes while for corporations those last three represent the branch code.

Speaking of branch code, some people mistake it as being the same as the RDO code, but it’s different. An RDO code is made up of only three digits while the branch code can be three to five digits and is a part of the TIN that functions as an effective way to easily identify the taxpayer (“000” will mean it’s an individual taxpayer, otherwise it will be a corporate taxpayer).

How To Find Your BIR RDO Code

So now, for those who may not have had the need to know what their RDO code is but are intrigued about it, how do you check what’s yours? Well, there are three ways to go about it:

Checking the BIR Forms

This is the easiest way to do it. Companies hiring new employees who don’t have a TIN yet are required to register them with the BIR by making them fill out BIR Form 1902 and then submitting that within 10 days from the hiring date.

The TIN will be generated and assigned to the new employee. The RDO code will also be reflected in the form. Should the employee need to know what their RDO code is in the future, they can just request a copy from the HR department of their company.

When it comes to self-employed individuals, they should check out a copy of their BIR Form 1901 that they filed when they first registered as a taxpayer with the BIR.

Corporate taxpayers, on the other hand, would find their RDO code in BIR Form 1903.

One-time taxpayers (those who pay for donor’s tax, estate tax, capital gains tax, or some other one-time tax such as when they won in a raffle or contest), meanwhile, should look at their copy of BIR Form 1904 for their RDO.

If you have transferred RDO, you can find your new RDO code in the copy of BR Form 1905 that you submitted when you requested the transfer.

Calling the BIR Hotline

This is a hit-and-miss thing since government telephones in the Philippines are notoriously hard to reach (except those for emergencies). The BIR hotline, which was previously known as the BIR Contact Center and is now the Customer Assistance Division (CAD) can be reached at telephone number 8538-3200.

Going to an RDO

Of course, when all else fails, like you can’t find any of the aforementioned forms or you can’t get through the BIR hotline, the best thing is to visit the nearest RDO. This could be a time-consuming process that could affect the regular operation of companies, especially startups.

If you do visit the RDO yourself, you will need to ask for a TIN verification slip, which you need to fill out. Most likely, you would need to queue for your turn, as most BIR branches are usually packed with people transacting their businesses. Make sure you line up to the correct window, so you won’t waste your time. In contrast, it’s just a matter of a few minutes for the BIR officer to find your RDO code and RDO location and even your TIN.

BIR RDO Codes in the Philippines

You do have another option to find out what your RDO code is, and that is by checking out this handy list that we are providing here. You just need to make sure that you (or your employer) haven’t transferred to another RDO previously.

RDO Codes and Corresponding RDOs

To make it easier for you to find your RDO code and which district office has jurisdiction, here’s the updated 2023 list of RDOs according to revenue region:

Revenue Region: 1 – Calasiao

RDO Code – District Office

001 – Laoag, Ilocos Norte

002 – Vigan, Ilocos Sur

003 – San Fernando City, La Union

004 – Calasiao, Central Pangasinan

005 – Alaminos City, West Pangasinan

006 – Urdaneta City, East Pangasinan

Revenue Region: 2 – Cordillera Administrative Region

RDO Code – District Office

007 – Bangued, Abra

008 – Baguio City

009 – La Trinidad, Benguet

010 – Bontoc, Mt. Province

011 – Tabuk City, Kalinga

012 – Lagawe, Ifugao

Revenue Region: 3 – Tuguegarao City

RDO Code – District Office

013 – Tuguegarao City, Cagayan

014 – Bayombong, Nueva Vizcaya

015 – Naguilan, Isabela

016 – Cabarroguis, Quirino

Revenue Region: 4 – City of San Fernando, Pampanga

RDO Code – District Office

17A – Tarlac City, Tarlac

17B – Paniqui, Tarlac

018 – Olongapo City, Zambales

019 – Subic Bay Freeport Zone

020 – Balanga City, Bataan

21A – Angeles City, North Pampanga

21B – City of San Fernando, South Pampanga

21C – Clark Freeport Zone

022 – Baler, Aurora

23A – Talavera, North Nueva Ecija

23B – Cabanatuan City, South Nueva Ecija

Revenue Region: 5 – Caloocan City

RDO Code – District Office

024 – Valenzuela City

25A – West Bulacan

25B – East Bulacan

026 – Malabon City-Navotas

027 – Caloocan City

Revenue Region: 6 – City of Manila

RDO Code – District Office

029 – Tondo-San Nicolas

030 – Binondo

031 – Sta. Cruz

032 – Quiapo-Sampaloc-Sta. Mesa-San Miguel

033 – Intramuros-Ermita-Malate

034 – Paco-Pandacan-Sta. Ana-San Andres

036 – Puerto Princesa City, Palawan

Revenue Region: 7A – Quezon City

RDO Code – District Office

028 – Novaliches

038 – North Quezon City

039 – South Quezon City

040 – Cubao

Revenue Region: 7B – East NCR

RDO Code – District Office

041 – Mandaluyong City

042 – San Juan

043 – Pasig

045 – Marikina

046 – Cainta/Taytay

Revenue Region: 8A – Makati City

RDO Code – District Office

047 – East Makati

048 – West Makati

049 – North Makati

050 – South Makati

Revenue Region: 8B – South NCR

RDO Code – District Office

044 – Taguig City-Pateros

051 – Pasay City

052 – Paranaque City

53A – Las Pinas City

53B – Muntinlupa City

Revenue Region: 9A – CABAMIRO (Cavite-Batangas-Mindoro-Romblon)

RDO Code – District Office

035 – Odiongan, Romblon

037 – San Jose, Occidental Mindoro

54A – Trece Martirez City, East Cavite

54B – Kawit, West Cavite

058 – Batangas City, West Batangas

059 – Lipa City, East Batangas

063 – Calapan, Oriental Mindoro

Revenue Region: 9B – LAQUEMAR (Laguna-Quezon-Marinduque)

RDO Code – District Office

055 – San Pablo City, East Laguna

056 – Calamba City, Central Laguna

057 – Binan City, West Laguna

060 – Lucena City, North Quezon

061 – Gumaca, South Quezon

062 – Boac, Marinduque

Revenue Region: 10 – Legazpi City

RDO Code – District Office

064 – Talisay, Camarines Norte

065 – Naga City, Camarines Sur

066 – Iriga City, Camarines Sur

067 – Legazpi City, Albay

068 – Sorsogon City, Sorsogon

069 – Virac, Catanduanes

070 – Masbate City, Masbate

Revenue Region: 11 – Iloilo City

RDO Code – District Office

071 – Kalibo, Aklan

072 – Roxas City, Capiz

073 – San Jose, Antique

074 – Iloilo City, Iloilo

075 – Zarraga, Iloilo

Revenue Region: 12 – Bacolod City

RDO Code – District Office

076 – Victorias City, Negros Occidental

077 – Bacolod City, Negros Occidental

078 – Binalbagan, Negros Occidental

079 – Dumaguete City, Negros Oriental

Revenue Region: 13 – Cebu City

RDO Code District Office

080 – Mandaue City, Cebu

081 – Cebu City North

082 – Cebu City South

083 – Talisay City, Cebu

084 – Tagbilaran City, Bohol

Revenue Region: 14 – Eastern Visayas Region

RDO Code – District Office

085 – Catarman, Northern Samar

086 – Borongan City, Eastern Samar

087 – Calbayog City, Samar

088 – Tacloban City, Leyte

089 – Ormoc City, Leyte

090 – Maasin City, Southern Leyte

Revenue Region: 15 – Zamboanga City

RDO Code – District Office

091 – Dipolog City, Zamboanga del Norte

092 – Pagadian City, Zamboanga del Sur

93A – Zamboanga City, Zamboanga del Sur

93B – Ipil, Zamboanga Sibugay

094 – Isabela City, Basilan

095 – Jolo, Sulu

096 – Bongao, Tawi-Tawi

Revenue Region: 16 – Cagayan de Oro City

RDO Code – District Office

097 – Gingoog City, Misamis Oriental

098 – Cagayan de Oro City, Misamis Oriental

099 – Malaybalay City, Bukidnon

100 – Ozamis City, Misamis Occidental

101 – Iligan City, Lanao del Norte

102 – Marawi City, Lanao del Sur

Revenue Region: 17 – Butuan City

RDO Code – District Office

103 – Butuan City, Agusan del Norte

104 – Bayugan City, Agusan del Sur

105 – Surigao City, Surigao del Norte

106 – Tandag City, Surigao del Sur

Revenue Region: 18 – Koronadal City

RDO Code – District Office

107 – Cotabato City, Maguindanao

108 – Kidapawan, North Cotabato

109 – Tacurong, Sultan Kudarat

110 – General Santos City, South Cotabato

111 – Koronadal City, South Cotabato

Revenue Region: 19 – Davao City

RDO Code – District Office

112 – Tagum City, Davao del Norte

113A – West Davao City

113B – East Davao City

114 – Mati City, Davao Oriental

115 – Digos City, Davao del Sur

When do you need to transfer to a different RDO?

Transferring to another RDO is a necessary step if you will be working for a company that is operating in an RDO that is different from yours. Similarly, if you will be transferring your business to a private office for rent in BGC or Makati, which would be under a different RDO, an RDO transfer is also a necessity. This is to make sure that your record as a taxpayer will be updated and that your tax contributions will be properly recorded.

Transferring Your RDO Using BIR Form 1905

As mentioned earlier, you would need BIR Form 1905 to transfer RDO. It’s one of the requirements that you need to satisfy before you start working for a new company.

What is BIR Form 1905?

BIR Form 1905 is used to make changes to a taxpayer’s information, including registered address, the registered name of business, civil status, contact information and contact person, and stockholders/partners/members.

Types of RDO Transfers

1. RDO transfer of one-time taxpayers/persons registered under EO 98/employees registering a new business

2. RDO transfer of employees with a new employer

3. RDO transfer of employers transferring to a new RDO

4. RDO transfer of corporate and self-employed taxpayers

You will need to present two copies of your accomplished BIR Form 1905. As well, you will need to provide your present RDO code. If you don’t know what it is, just refer to our earlier discussion on finding your BIR RDO code.

It’s also important to make sure that you tick off Field 7B in the form, which is the option “Change in Registered Address.”

Submit the accomplished BIR Form 1905 to your old RDO, which should process your transfer request within one week.

Frequently Asked Questions

Here are some other concerns that you may have about RDO codes:

Question: If my company moves to a new address with a new RDO, should all of us employees apply for a change in RDO too?

Answer: Yes. Employees need to fill out BIR Form 1905 for the purpose, but their company should be the one to have it processed. However, if an employee lives at the address that the company is moving into, that employee won’t need to change RDO.

Question: What if I don’t update my RDO when I work for a new company in a different location?

Answer: If your new employer doesn’t require you to change RDO, the withholding tax your new employer will deduct from your salary will be remitted to your existing RDO, but it will be considered a “non-payment” in the unlikely event that you get audited.

Final Thoughts

Knowing what your RDO Code may not be as crucial as regularly paying your taxes, but it will prove important if you will be required to provide it. So, to avoid any hassle and unnecessary stress, it would be better if you keep a record of it, especially if you will be registering as a taxpayer for the very first time or if you are starting a new job with a different employer.

This is also important for startup businesses with several employees. You would be doing a great favor to your workforce if you can help them take care of this simple requirement that can become complicated if it’s not given the proper attention.

And whether you are operating a business in an actual office or a virtual office, making sure you are remitting your taxes to the right RDO will help avoid dealing with tax issues later.

If you are also on the lookout for a private office space for rent in Makati, BGC, Alabang, or Ortigas, Weremote has that too.

Weremote stands as a community where professionals and businesses thrive, offering a dynamic environment for growth. As the coworking brand of Wrkspace Office Management and Solutions Inc., Weremote continues to foster professional development and build vibrant communities. Weremote is a portfolio company of AHG Lab, the largest independent venture builder in the Philippines.